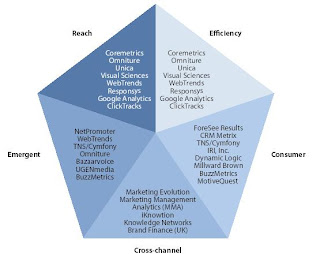

To cut through the plethora of metrics available today, interactive marketers must understand the various types of measurement and appreciate how they fit together and complement each other. This reports looks at the main "buckets" of metrics and their benefits:

1) Reach (basic, primarily reach-related)

2) Efficiency (insight into consumer behavior across channels)

3) Consumer (attitudinal and longer term)

4) Cross-channel (models revealing the impact each channel has separately and together)

5) emerging metrics (such as online sentiment).

REACH METRICS OFFER A GOOD - BUT SHALLOW - STARTING POINT

The most basic of online measures, reach metrics track primarily how many people are exposed to campaigns, along with some simple reaction measures. For instance, the number of impressions, unique viewers, or ad click-throughs would be reach metrics.

These metrics provide a good starting point for interactive marketers just beginning to measure campaign results because they:

- can be tracked easily and cheaply (with free applications such as Site Meter, Google Analytics).

- Allow for simple benchmarking

- Enable initial comparison with offline efforts. Some reach metrics, like ad impressions or monthly unique users to a site, can at a very basic level be weighed against television program viewership or magazine subscribers, thus aiding cross-media planning. Of course, reach metrics reveal little about media users. Marketers need more advanced metrics to decide which would perform better, a TV spot or an online ad, even if both were likely to reach 500,000 consumers.

EFFICIENCY METRICS MEASURE RELATIVE CHANNEL EFFECTIVENESS

Reach metrics are popular and easy to track but they only measure what users do, not what drives them to do it. Slightly more sophisticated than reach metrics, efficiency metrics let interactive marketers gain insight into the relative effectiveness of each channel in their mix by:

- Inferring consumer attitudes or satisfaction-

- Comparing the cost-effectiveness of different online channels. Efficiency metrics include cost per click, cost per keyword, cost per acquisition.

- Automating insight-gathering.

consumer metrics reveal consumer attitudes and behaviors in response to marketing efforts, instead of just inferring the as efficiency metrics do. These metrics:

- Disclose consumer influences and intentions. Through surveys, interviews, or self-reported consumer feedback. These metrics help marketers evaluate the emotional effect marketing has on consumer separately from the actions it drives them to take. For example, metrics like "satisfaction" or "willingness to recommend" can indicate a customer's long-term brand engagement better than the more immediate "did they buy/click?"

- Develop loyalty insight over time. Operational and efficiency metrics measure results of a single interaction; consumer metrics track changes in user behavior over time. Metrics such as recency (time since a consumer engaged with a marketer), frequency (how often they do so), retention (level of repeat custom/engagement), and changes in purchase size (for retailers) give marketers insight into how to target messages. For example, those who visit and spend frequently on a site might be sent invites to a “Special Customers Only” event, while frequent visitors who rarely buy may be prompted into purchase by a discount email on products they often look at.

The most sophisticated of interactive metrics, cross-channel metrics measure the synergies between different channels within a multi-channel campaign and the combined effect of these channels to influence desired marketing outcomes. cross-channel metrics include:

- Return on marketing objectives (ROMO). ROMO looks at the effectiveness of marketing spend. Specifically, it tackles how well a marketing investment delivers on its defined objectives, such as building awareness of a new product launch or driving sales of a seasonal offer. The most important factors when using ROMO is to ensure that the goals of the marketing investment are clearly defined

- Revenue contributions by marketing activity (marketing mix models). This methodology uses statistical techniques such as linear and multivariate regression analysis to look for correlations between marketing activity and sales volume and teases out metrics such as the sales impact of individual media or promotional elements of a campaign. For example, a brand manager can build a model comparing the amount of revenue attributable to coupons delivered via online ads or trade promotions, while an advertising manager can determine the effects of TV, radio, Internet, and print ads. Marketing mix modelers have measured traditional media for years, and some now include online data, even though the methodology works best when based on extensive historical data, which many interactive marketers lack.

- Profitability metrics. By making assumptions about the impact of consumer perceptions and behavior on retention and conversion rates, and by incorporating measurement of sales volumes, values, and changes, marketers can analyze the influence of interactive channels on direct value and profitability metrics such as customer lifetime value (CLV) and return on investment (ROI). These metrics require marketers to have quite high-level insight into the investments and returns of their business, so to use them a marketer will need direct financial responsibilities or strong liaisons in corporate finance or operations.

NEW MEASUREMENT TYPES WILL APPEAR FOR NEW MEDIA

An consumers spend more time in new social media, marketers will look for additional metrics like consumer buzz or peer referrals to track nontraditional marketing results. Some new metrics in this arena include:

- Online brand perception. Whether for public relations activities, fraud violations, or competitive intelligence, marketers have long monitored media for information related to their brands. But fragmenting media and changing consumer behavior means there are now millions of potential sources of comment. For example, Technorati currently tracks over 110 million blogs, along with 250 million pieces of tagged social media. This means that marketers have to up the ante on how they track mentions of their companies and brands online, which normally means turning to a third-party tracking company. For example, Toyota uses BuzzMetrics to monitor online attitudes to marketing such as TV spots.

- Consumer engagement. Engagement is the level of involvement, interaction, intimacy, and influence an individual has with a brand over time, giving a more holistic overview of a brand’s influence and the customer’s actions. To measure engagement, marketers should monitor consumer behaviors like length of game play, comments made in forums, type and frequency of content uploaded, or items tagged, as well as qualitative metrics like net promoter scores or the influence an engaged customer has on others. Measuring engagement is a complex task, which requires that even sophisticated marketers significantly invest in the services of multiple vendors. Marketers looking to track engagement should begin by focusing on a small set of objectives (such as linking positive reviews to increased basket sizes) and concentrate on unifying their view of the customer across channels.

REACH OUT TO VENDORS FOR ACTIONABLE TRACKING AND REPORTING

Many interactive marketers struggling with extracting insight from metrics can find help by engaging a third-party expert vendor (see figure). Marketers should evaluate vendor partners by asking themselves the following questions:

- What in-house capability do we have? As the importance of analytics grows, many marketing teams will find that their current staffing — at least in the short term — lacks the expertise to get the most out of analytics packages. Web analytics leaders like Omniture and Unica can help here, especially for marketing teams who demand extensive customization and have the expertise to support and maintain the implementation. Smaller marketing teams will probably be better off with vendors that can provide analytic advice and analysis, such as MotiveQuest in the brand monitoring space, or even devolving responsibility to their interactive agency, as long as it’s one with strong analytics capabilities, such as OgilvyInteractive.

- What level of cross-channel sophistication do we need? Are you running small, online-only programs or coordinating extensive cross-channel efforts? Effective measurement within one channel needn’t require extensive investment. Simple, free tools such as Yahoo!’s Search Management dashboard can help new online marketers track their efforts in search, while email service providers such as e-Dialog provide extensive email analytics as standard. Marketers with complex multi- and cross-channel investments, however, will require vendors like Marketing Management Analytics, which can cope with sophisticated marketing mix models, or solutions like Omniture, which can bring together measurements from multiple sources.

- Do we require in-depth industry expertise? How important to you is focus within your own vertical? Many vendors, including Omniture, operate across a wide variety of verticals, while others prefer to narrow it down. Brand monitoring vendor Brandimensions, for example, focuses strongly on automotive, entertainment, and pharmaceuticals. Vertical specialization means these vendors have expertise in the most industry-relevant metrics plus experience creating strategy out of these measures. However, vertically oriented vendors may be less apt to parlay learnings from one industry into another. Marketers prioritizing vendors with industry experience should be careful to not fall into the trap of thinking, “It worked for client X so it will work for client Y.”

R E C O M M E N D A T I O N S

MAKE METRICS WORK FOR YOU BY FOCUSING ON RELEVANCE

Not all metrics will be equally relevant to all marketers; marketers should emphasize the metrics that address their goals. For example, metrics such as search keyword click-throughs and basket size over time resonate with online retailers, whereas consumer packaged goods (CPG) companies may focus on brand awareness and marketing mix models. To ensure they focus on the metrics most important to their business, interactive marketers must:

- Not measure everything. Just because you can measure something doesn’t mean you should. In fact, the amount of online data available can paralyze marketers who try to track it all. Better to focus on a small subset of metrics that align closely with clearly defined business goals. Retailers looking to increase online sales should track metrics that relate directly to revenue growth such as visitor traffic, click-throughs by product type, and conversion rates. Media advertisers such as film studios aiming to drive awareness and ticket sales should focus on time spent watching rich media spots, number of registrants for associated games, and sentiment expressed in online film review forums. Vertically oriented measurement vendors can help you identify which metrics track to your business goals.

- Continually review the metrics you use. For marketers venturing into new online channels, the most important — and actually most usable — metrics may not be immediately obvious. To identify which metrics are actually helping diagnose marketing performance, interactive marketers should continually review which metrics: 1) Correlate directly with business goals; 2) Provide insights that improve results; and 3) Turn out not to give useful insight.

For example, retailers may find that dwell time on product pages is not related to purchase likelihood, whereas time spent reading product reviews is. - Translate interactive jargon into common business terms. Metrics such as CPC, unique visitors, and impressions are often meaningless to those not in the interactive marketing space. To engage this audience — which often includes the CMO — and encourage wider view of the value of interactive metrics, marketers need to translate “unique visitors” to “reach” and “stickiness” to “duration.” Additionally, many customer metrics, such as satisfaction, brand attitudes, and purchase intent, are shared between interactive and traditional channels and can provide a common ground of multi-media measurement discussions.

- Get metrics out into the business. Instead of letting metrics live only within an online dashboard or in monthly printouts, interactive marketers should think about how they can leverage provable success stories throughout the business. Share the latest highlights with other brand managers at strategy meetings, or incorporate metrics into cross-department reward structures. One idea: Bonus stakeholders on achieving desired interactive results. Give online marketers, product developers, and copywriters a bonus when their product page achieves the lowest SAR in a week.