Trends, Insights & Tips for Digital Marketers focused on Online Customer Experience, Social Media & Technology

Wednesday, December 24, 2008

Wishing you a happy holiday n Merry Christmas!

Saturday, December 13, 2008

Marketing Metrics you Need for Interactive Marketing

To cut through the plethora of metrics available today, interactive marketers must understand the various types of measurement and appreciate how they fit together and complement each other. This reports looks at the main "buckets" of metrics and their benefits:

1) Reach (basic, primarily reach-related)

2) Efficiency (insight into consumer behavior across channels)

3) Consumer (attitudinal and longer term)

4) Cross-channel (models revealing the impact each channel has separately and together)

5) emerging metrics (such as online sentiment).

REACH METRICS OFFER A GOOD - BUT SHALLOW - STARTING POINT

The most basic of online measures, reach metrics track primarily how many people are exposed to campaigns, along with some simple reaction measures. For instance, the number of impressions, unique viewers, or ad click-throughs would be reach metrics.

These metrics provide a good starting point for interactive marketers just beginning to measure campaign results because they:

- can be tracked easily and cheaply (with free applications such as Site Meter, Google Analytics).

- Allow for simple benchmarking

- Enable initial comparison with offline efforts. Some reach metrics, like ad impressions or monthly unique users to a site, can at a very basic level be weighed against television program viewership or magazine subscribers, thus aiding cross-media planning. Of course, reach metrics reveal little about media users. Marketers need more advanced metrics to decide which would perform better, a TV spot or an online ad, even if both were likely to reach 500,000 consumers.

EFFICIENCY METRICS MEASURE RELATIVE CHANNEL EFFECTIVENESS

Reach metrics are popular and easy to track but they only measure what users do, not what drives them to do it. Slightly more sophisticated than reach metrics, efficiency metrics let interactive marketers gain insight into the relative effectiveness of each channel in their mix by:

- Inferring consumer attitudes or satisfaction-

- Comparing the cost-effectiveness of different online channels. Efficiency metrics include cost per click, cost per keyword, cost per acquisition.

- Automating insight-gathering.

consumer metrics reveal consumer attitudes and behaviors in response to marketing efforts, instead of just inferring the as efficiency metrics do. These metrics:

- Disclose consumer influences and intentions. Through surveys, interviews, or self-reported consumer feedback. These metrics help marketers evaluate the emotional effect marketing has on consumer separately from the actions it drives them to take. For example, metrics like "satisfaction" or "willingness to recommend" can indicate a customer's long-term brand engagement better than the more immediate "did they buy/click?"

- Develop loyalty insight over time. Operational and efficiency metrics measure results of a single interaction; consumer metrics track changes in user behavior over time. Metrics such as recency (time since a consumer engaged with a marketer), frequency (how often they do so), retention (level of repeat custom/engagement), and changes in purchase size (for retailers) give marketers insight into how to target messages. For example, those who visit and spend frequently on a site might be sent invites to a “Special Customers Only” event, while frequent visitors who rarely buy may be prompted into purchase by a discount email on products they often look at.

The most sophisticated of interactive metrics, cross-channel metrics measure the synergies between different channels within a multi-channel campaign and the combined effect of these channels to influence desired marketing outcomes. cross-channel metrics include:

- Return on marketing objectives (ROMO). ROMO looks at the effectiveness of marketing spend. Specifically, it tackles how well a marketing investment delivers on its defined objectives, such as building awareness of a new product launch or driving sales of a seasonal offer. The most important factors when using ROMO is to ensure that the goals of the marketing investment are clearly defined

- Revenue contributions by marketing activity (marketing mix models). This methodology uses statistical techniques such as linear and multivariate regression analysis to look for correlations between marketing activity and sales volume and teases out metrics such as the sales impact of individual media or promotional elements of a campaign. For example, a brand manager can build a model comparing the amount of revenue attributable to coupons delivered via online ads or trade promotions, while an advertising manager can determine the effects of TV, radio, Internet, and print ads. Marketing mix modelers have measured traditional media for years, and some now include online data, even though the methodology works best when based on extensive historical data, which many interactive marketers lack.

- Profitability metrics. By making assumptions about the impact of consumer perceptions and behavior on retention and conversion rates, and by incorporating measurement of sales volumes, values, and changes, marketers can analyze the influence of interactive channels on direct value and profitability metrics such as customer lifetime value (CLV) and return on investment (ROI). These metrics require marketers to have quite high-level insight into the investments and returns of their business, so to use them a marketer will need direct financial responsibilities or strong liaisons in corporate finance or operations.

NEW MEASUREMENT TYPES WILL APPEAR FOR NEW MEDIA

An consumers spend more time in new social media, marketers will look for additional metrics like consumer buzz or peer referrals to track nontraditional marketing results. Some new metrics in this arena include:

- Online brand perception. Whether for public relations activities, fraud violations, or competitive intelligence, marketers have long monitored media for information related to their brands. But fragmenting media and changing consumer behavior means there are now millions of potential sources of comment. For example, Technorati currently tracks over 110 million blogs, along with 250 million pieces of tagged social media. This means that marketers have to up the ante on how they track mentions of their companies and brands online, which normally means turning to a third-party tracking company. For example, Toyota uses BuzzMetrics to monitor online attitudes to marketing such as TV spots.

- Consumer engagement. Engagement is the level of involvement, interaction, intimacy, and influence an individual has with a brand over time, giving a more holistic overview of a brand’s influence and the customer’s actions. To measure engagement, marketers should monitor consumer behaviors like length of game play, comments made in forums, type and frequency of content uploaded, or items tagged, as well as qualitative metrics like net promoter scores or the influence an engaged customer has on others. Measuring engagement is a complex task, which requires that even sophisticated marketers significantly invest in the services of multiple vendors. Marketers looking to track engagement should begin by focusing on a small set of objectives (such as linking positive reviews to increased basket sizes) and concentrate on unifying their view of the customer across channels.

REACH OUT TO VENDORS FOR ACTIONABLE TRACKING AND REPORTING

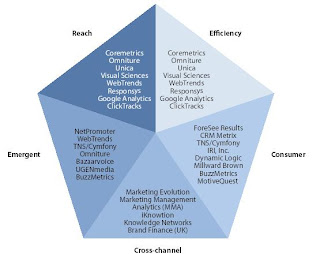

Many interactive marketers struggling with extracting insight from metrics can find help by engaging a third-party expert vendor (see figure). Marketers should evaluate vendor partners by asking themselves the following questions:

- What in-house capability do we have? As the importance of analytics grows, many marketing teams will find that their current staffing — at least in the short term — lacks the expertise to get the most out of analytics packages. Web analytics leaders like Omniture and Unica can help here, especially for marketing teams who demand extensive customization and have the expertise to support and maintain the implementation. Smaller marketing teams will probably be better off with vendors that can provide analytic advice and analysis, such as MotiveQuest in the brand monitoring space, or even devolving responsibility to their interactive agency, as long as it’s one with strong analytics capabilities, such as OgilvyInteractive.

- What level of cross-channel sophistication do we need? Are you running small, online-only programs or coordinating extensive cross-channel efforts? Effective measurement within one channel needn’t require extensive investment. Simple, free tools such as Yahoo!’s Search Management dashboard can help new online marketers track their efforts in search, while email service providers such as e-Dialog provide extensive email analytics as standard. Marketers with complex multi- and cross-channel investments, however, will require vendors like Marketing Management Analytics, which can cope with sophisticated marketing mix models, or solutions like Omniture, which can bring together measurements from multiple sources.

- Do we require in-depth industry expertise? How important to you is focus within your own vertical? Many vendors, including Omniture, operate across a wide variety of verticals, while others prefer to narrow it down. Brand monitoring vendor Brandimensions, for example, focuses strongly on automotive, entertainment, and pharmaceuticals. Vertical specialization means these vendors have expertise in the most industry-relevant metrics plus experience creating strategy out of these measures. However, vertically oriented vendors may be less apt to parlay learnings from one industry into another. Marketers prioritizing vendors with industry experience should be careful to not fall into the trap of thinking, “It worked for client X so it will work for client Y.”

R E C O M M E N D A T I O N S

MAKE METRICS WORK FOR YOU BY FOCUSING ON RELEVANCE

Not all metrics will be equally relevant to all marketers; marketers should emphasize the metrics that address their goals. For example, metrics such as search keyword click-throughs and basket size over time resonate with online retailers, whereas consumer packaged goods (CPG) companies may focus on brand awareness and marketing mix models. To ensure they focus on the metrics most important to their business, interactive marketers must:

- Not measure everything. Just because you can measure something doesn’t mean you should. In fact, the amount of online data available can paralyze marketers who try to track it all. Better to focus on a small subset of metrics that align closely with clearly defined business goals. Retailers looking to increase online sales should track metrics that relate directly to revenue growth such as visitor traffic, click-throughs by product type, and conversion rates. Media advertisers such as film studios aiming to drive awareness and ticket sales should focus on time spent watching rich media spots, number of registrants for associated games, and sentiment expressed in online film review forums. Vertically oriented measurement vendors can help you identify which metrics track to your business goals.

- Continually review the metrics you use. For marketers venturing into new online channels, the most important — and actually most usable — metrics may not be immediately obvious. To identify which metrics are actually helping diagnose marketing performance, interactive marketers should continually review which metrics: 1) Correlate directly with business goals; 2) Provide insights that improve results; and 3) Turn out not to give useful insight.

For example, retailers may find that dwell time on product pages is not related to purchase likelihood, whereas time spent reading product reviews is. - Translate interactive jargon into common business terms. Metrics such as CPC, unique visitors, and impressions are often meaningless to those not in the interactive marketing space. To engage this audience — which often includes the CMO — and encourage wider view of the value of interactive metrics, marketers need to translate “unique visitors” to “reach” and “stickiness” to “duration.” Additionally, many customer metrics, such as satisfaction, brand attitudes, and purchase intent, are shared between interactive and traditional channels and can provide a common ground of multi-media measurement discussions.

- Get metrics out into the business. Instead of letting metrics live only within an online dashboard or in monthly printouts, interactive marketers should think about how they can leverage provable success stories throughout the business. Share the latest highlights with other brand managers at strategy meetings, or incorporate metrics into cross-department reward structures. One idea: Bonus stakeholders on achieving desired interactive results. Give online marketers, product developers, and copywriters a bonus when their product page achieves the lowest SAR in a week.

Tuesday, December 2, 2008

What is the Long tail and how does It apply to Google?

Traditionally records, books, movies, and other items were geared towards creating "hits".

Stores could only afford to carry the most popular items because they needed enough people in an area to buy their goods in order to recoup their overhead expenses.

The Internet changes that. It allows perople to find less popular items and subjects. It turns out that there's profit in those "misses", too. Amazon can sell obscure books, Netflix can rent obscure movies, and iTunes can sell obscure songs. That's all possible because the Internet has taken geographic location out of the equation.

HOW DOES THIS APPLY TO GOOGLE?

Adsense and Adwords are performace based, so niche advertisers and niche content publishers can all take advantage of them.

HOW DOES THIS APPLY TO SEO

If your business depends on people finding your websites in Google, the Long-Tail is very important. Rather than focusing on making one web page the most popular web page, concentrate on making lots of pages that serve niche markets.

People can refer to the most popular items, pages, or widgets as the "Head", as opposed to the Long-Tail. They also sometimes refer to the "thick tail", meaning the more popular items on the Long Tail.

After a certain point, the Long Tail ends up dipping off into obscurity. If only one or two people ever visit your website, you're probably never going to make any money from advertising on it. Likewise, if you're a blogger who writes on a very niche topic, it will be difficult to find enough of an audience to pay for your efforts.

Google makes money from the most popular ads on the head down to the thinnest section of the Long Tail. They still make money from the blogger that hasn't made the minimum earning requirement for an AdSense payment.

Content publishers have a different challenge with the Long Tail. If you're making money with content that fits in the Long Tail, you want a thick enough portion to make it worthwhile. Keep in mind that you still need to make up for your losses in quantity by offering more variety. Instead of concentrating on one blog, maintain three or four on different topics.

Google Sms Channels - A Threat Or A Boon For SmsGupshup & MyToday?

Saturday, November 29, 2008

iPhone is now the #1 mobile advertising device worldwide

Worldwide requests grew 13.8 percent month over month to 5.8 billion. US requests grew 7.9 percent to 2.2 billion and UK requests grew 16.0 percent.

Sony Ericsson passed Motorola to become the #2 handset manufacturer worldwide. Apple jumped ahead of LG and RIM to become the #5 handset manufacturer worldwide.

The top 10 devices worldwide, in order, are the Apple iPhone, Motorola RAZR V3, Nokia N70, Motorola KRZR K1c, Motorola W385, Nokia 6300, Nokia 3110c, Nokia N73, Motorola Z6m, and RIM BlackBerry 8300.

Friday, November 28, 2008

India Online 2008

- JuxtConsult, June 2008

Monday, November 24, 2008

5 Ways to Convert Offline Strategy to Online Marketing Success

You may tend to look at offline and online marketing differently, building separate strategies and marketing plans for each. This may not be the most efficient way to grow your business. Most goals and strategies that work offline apply online as well (and vice versa). The underlying concepts are the same, but executions differ. Some examples follow.

Targeting and Differentiating

Targeting and differentiation are based on the premise that each of your products, services or ideas is useful to some people and not to others. That premise is the same whether your business is online, offline or both. You differentiate your business from competitors so that people can understand the benefits you bring to them that others do not. You target your audience by delivering marketing messages so that those benefits are exposed to the people that need them. Offline, that could mean advertising in certain newspapers your target customers read. Online, those same messages can be delivered directly from your Website, through pay per click advertising or through emailed newsletters.

Increasing Repeat Sales

Your existing customers (or clients) are important to you whether they were acquired virtually through a Website, or physically through a retail store or salesperson. They have already bought into the benefits you bring to them and are likely to purchase more if given the opportunity. Those opportunities to increase repeat sales can be offered online, offline or both.

- Communication with existing customers can encourage repeat orders. Offline, this can be through mailings or catalogues. Online, emailed newsletters or RSS feeds can keep customers up-to-date on new products, discounts and other news of interest.

- Customer service can make ordering easier for both repeat and new customers. Offline, "operators standing by" can help customers through the process and suggest appropriate add-ons to an order. This can apply online as well with live customer chat.

- Loyalty programs are another way to increase repeat sales by existing customers. Those who purchase repeatedly from you receive some compensation (such as dollars back or free product). This type of program can work online as well as offline. Offline, customers present their loyalty program number or card directly. Online, they fill in a promo code or comment field stating they are loyalty program members.

Testing

Testing is a marketing and research concept that can be implemented both offline and online. When marketing offline, in order to improve conversion or response rates, we often test by exposing different versions of a program to sample audiences before fully implementing the program (through a trial postcard mailing, new product test markets, or other marketing research methods, for example). The exact concept applies online as well.

One way to conduct online testing is by split testing different versions of your sales (or other Website) page. Using split testing software or a script, you can rotate through different versions of a Web page to see which is most effective. Just as with offline testing methods, you can analyze the conversion or response rates of each version to see which performs better. In fact, online testing is easier because the logistics are easier; unlike similar offline tests, there is nothing to print and distribute to the target audience.

Adapting To Change

Offline or on, trends and customer preferences change over time. To compete, you must change with them. This means adapting all of your marketing and products/services over time, whether they are Web or "brick and mortar" based. By thinking of your offline and online activities as two different ways of marketing the same business marketing strategies, you can more efficiently incorporate those changes to all of your offline and online activities.

Trusting Your Intuition

"Going with your gut" is one strategy you aren't likely to find in any marketing book. After a certain amount of business experience, your intuition will, at times, come to a strategic conclusion before your brain does. If your intuition has a good track record, trust it. Here's why:

Every business – online, offline or blended – has an optimal marketing strategy uniquely its own. This is not only because each individual business is a bit different, but also because strengths and weaknesses (as well as preferences) of those involved create an environment like no other. In other words, given identical circumstances and identical marketing programs, the people involved will manage the execution differently in each company, creating different results. Those differences – the abilities of you and your people to execute some programs better than others, or to work with some outside agencies/services more effectively than with others – create more variables than can be easily captured by analysis. Your intuition, however, can capture those variables and guide you in making the best choices, whether they apply to online or offline marketing activities.

What is the impact of the SearchWiki on SEO?

So how will this impact SEO in the future? Very little, if at all – and this assumes that Google do find the feedback data valuable enough to include it as part of the algorithm. Google have already been taking user feedback into consideration when ranking result pages for some time, so if your site was performing well previously, it is obviously going down well with users and shall continue to do so. The SEO fundamentals remain the same, making sure your webpage is relevant enough to the users search query as possible.

Sunday, November 23, 2008

Where are Search Engines Most Likely To Innovate?

SOCIAL DATA INCLUSION